Report Summary

Period covered: January 2025

3 minute read

Note: This report summary is one or two months behind the current month as standard reporting practice. The content is indicative only and incomplete with certain data undisclosed. Become a member to access this data or take out a free 30 day membership trial now.

Online performance

January saw a muted online performance as cautious consumer sentiment and persistent economic pressures weighed on spending.

Online sales fell by xx% year-on-year, marking the weakest performance in nearly two years outside of seasonal distortions.

Online sales accounted for xx% of total retail sales, down from xx% a year ago and the lowest penetration rate since August 2024 (xx%).

Key factors impacting performance included health-conscious spending, cold and stormy weather, discounting and ongoing economic pressures:

Health-conscious spending drives category growth: Wellness trends fuelled demand for supplements, skincare, and protein-based products. ‘Dry January’ gained further momentum, lifting alcohol-free sales.

Cold weather fails to deter shoppers: January was defined by extreme contrasts, from Arctic cold early on to milder, stormier weather later. Heavy snow (in Northern England and Scotland), record-low temperatures mid-month, and freezing fog caused early disruptions, while storms Eowyn and Herminia brought powerful winds and heavy rain to parts of the UK. However, overall footfall still rose year-on-year, up xx%, the strongest increase outside the pandemic era since 2016.

Customer journey evolution

Shoppers are more connected than ever, moving seamlessly between online and offline touchpoints. This shift is reshaping retail, with online channels now dominating key non-food categories, including clothing and homewares.

Latest research from Retail Economics and NatWest reveals that success in 2025 hinges on understanding how shopping behaviours are shifting. AI-driven discovery, frictionless payments, and sustainable fulfilment are shaping expectations, while physical stores take on new roles as spaces.

Shifting role of physical stores

With more purchases shifting online, stores are adapting rather than disappearing. Many are becoming experience-led spaces where customers can explore products, attend events, and engage with brands in ways that digital-only retailers can’t replicate.

That said, demand for in-store shopping is easing in many non-essential categories. During the cost-of-living crisis, visiting stores often meant saving on delivery and return fees. Now, as financial pressures soften, online growth is accelerating again.

Take out a FREE 30 day membership trial to read the full report.

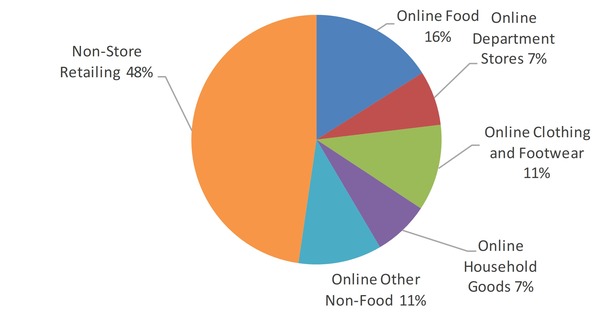

Proportion of online retail sales by category

Source: ONS, Retail Economics analysis

Source: ONS, Retail Economics analysis